Hi {{ FIRSTNAME | there, }}

New place? This international startup creates new rental market revenues by charging potential tenants to view properties. Yeah, most people think it’s crazy, but they also do 10-30 apartment tour packages, offer pre-approval and a host of handy financial services (plus benefits to landlords). Hmm… sounds like a model we should deep dive on… What do you think?

Hit reply and let us know…

Let’s help you spread the word

We would love to tell your stories, promote your jobs and share your stories! Fill in one of the forms on our website, and we can help you get the word out.

TRENDING NOW

Sending Cash Overseas (at a Fraction of the Cost)

Sending money across borders used to be complex, but startups are finding ways to do it much cheaper and faster...

South Africa controls how much money can leave the country to protect the rand. Citizens can send up to R1 million a year without approval (but it must be recorded), and up to R10 million with Reserve Bank approval.

Here’s the thing, though: SA has around 2.4 million migrants and expats working here and sending a little bit of money to help keep their families alive back home. When they send the money, they need to use a SARB-approved provider with a category 2 ADLA license.

And that can get pricey.

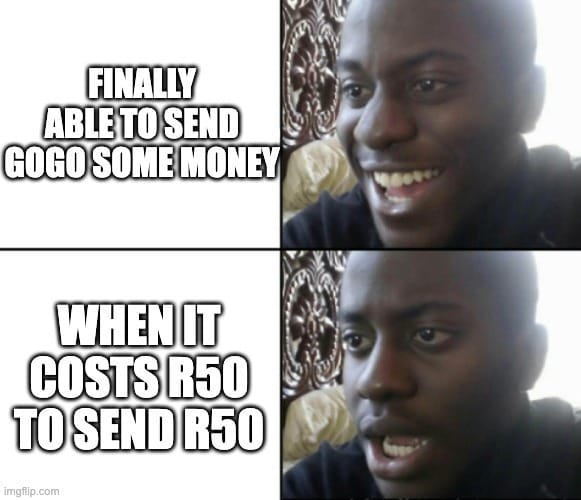

It’s expensive sending Rands overseas

According to the World Bank, sub-Saharan Africa has the highest remittance costs in the world. Sending Rands out of the country costs a pretty penny. Fees start at R50 — sometimes more than the money being sent — plus 1–2% forex charges.

Why so expensive? Regulation requires middlemen, systems like SWIFT and banks on both sides, which all add onto the fees, easily costing R250-R500 a transaction.

The problem

Those rules might help manage capital flight from the wealthy, but for migrant workers supporting families hand-to-mouth, it makes no sense.

If sending R50 costs R50, how does anyone get help?

Not to mention that traditional bank lines take 2–3 days to clear. There’s gotta be a better way, right?

The local player bringing a smart solution

SA solution headquartered in the UK, Zeam, uses stablecoins (that they created on the Stellar network) to let migrant workers send, save and spend without losing value. Peer-to-peer transactions are near-instant and 100% free — there’s only a cashout fee of around 1% (1.5% in Malawi and Zim).

For Zeam, keeping those fees low relies on them building a big network of redeemers fast, so they can avoid expensive cash conversions. But a bigger play would be to build a network of merchants across Africa that accept Zeam as currency, where merchants can offer cashbacks to Zeam for sending customers their way.

Bold play, but if they pull it off, it will be massive. We caught up with Zeam CEO Louis van Biljon recently, and while Zeam only launched in 2024, they already have over 60k users and rising. Looks like they’re onto something. We are watching this space…

FROM OUR FRIENDS AT CLOUD ON DEMAND

You're Wasting Money on Azure (Costs)

“We’re burning through cash and can’t explain half the Azure bill.”

If you’re a SaaS founder in South Africa right now, you probably recognise this:

Cloud costs are creeping up every month

Your infra is “working” but not optimised

You’re scared to scale because you don’t know what it’ll cost

You’re not alone — most SaaS startups on Azure overpay by 10–30%.

That’s why Cloud On Demand built a local Independent Software Vendor (ISV) program that gives SaaS startups a free, no-strings-attached cloud cost review, run by real Azure architects. They’ll show you exactly where you’re wasting money and what to change to fix it.

No lock-in. No bait-and-switch. Just clarity on where your cash is going.

If you’re bootstrapped, scaling or watching margins, this is one of the smartest 30-minute calls you can make.

Do it now and get the review done before Q3 budgets lock.

IN SHORT

While you were weekending…

📦 News24alotMore! TakealotMORE subscriptions now come with free News24 access and MVP Days (Black Friday-like sales exclusive for members)! Just as competition heats up from Amazon and Temu. Looks like the battle for your online shopping heart is only getting started.

🚀 Google's $2.4 Billion Talent Grab. Google is pulling out the cheque book, acquiring licenses and top tech wizards from AI startup Windsurf for a cool $2.4 billion. Windsurf's CEO and co-founder will now join Google's DeepMind, right after OpenAI's purchase deal collapsed. It’s interesting – no equity involved, just talent and ideas. Hmm, talent wars in AI are heating up.

💸 Payday Power Play. Earned wage access startup, Paymenow, has secured a $22.5 million working capital facility from Standard Bank. PayMeNow uses its facility to onlend wages to users. So the bigger the facility, the more loans they can issue, and the more money they make.

📞 Spam Calls Battle Upgraded. South Africa is introducing new rules for telemarketers under the POPI Act. As of April 2025, companies must secure better consent for using personal data, and opt-out just won’t cut it anymore. It’s like 2020’s POPIA intro sent spam calls into overdrive.

✅ The Stack. Founders need tools and suppliers they can trust. Check out our Founder’s Stack with full-funnel tech performance marketing by Stream, hardware, software, acceleration and funding for remarkable builds with Octoco and loads more vital startup tools & services.

FOR BUSINESS BUILDERS

The Founder Collab Turned One!

That’s right, our exclusive community for early-stage startup founders and side-hustlers turned 1 last week. And it’s been a MEGA year:

115 SA founders and side-hustlers joined up

We built a collection of 25+ masterclass recordings on topics like idea validation, fundraising, using AI to automate your business, building great products, sales and more.

50+ Weekly check-ins

9+ Social gatherings

AND countless launches, introductions, wins, laughs, learnings and good times building businesses together.

Are you a startup founder? What are you waiting for? Come and join SA’s only startup community dedicated to early-stage startup founders and side-hustlers.

WHAT YOU SAID

Never bitten…

Last Friday, we told you about SA’s R28 million snake antivenom opportunity, asking what the best thing is about snakebites. No surprise, most agree they’d die before a snake gets ‘em…

⬜️⬜️⬜️⬜️⬜️⬜️ 🛌 The couple of weeks of sick leave, bed rest, and catching up on Severance (3%)

🟨🟨🟨⬜️⬜️⬜️ 🔥 The story you get to tell around the campfire (27%)

🟨⬜️⬜️⬜️⬜️⬜️ 🦸 The Superpowers you develop, Snakeman/Snakewoman (13%)

🟨⬜️⬜️⬜️⬜️⬜️ 💰 The money you can make from selling the antibodies (10%)

⬜️⬜️⬜️⬜️⬜️⬜️ 🤷 Well, I guess that’s one way to cure my fear of snakes (3%)

🟩🟩🟩🟩🟩🟩 🚫 I’ll never know: I’d die before the snake even touches me (43%)

Your 2 cents…

“The campfire story: And show off your scar.”

He he, we read ‘car’ the first time, Chris. Still rolling. 🤣

LOVE IT?

THANKS FOR READING

Squad