Shoulda known? An old woman was tricked out of R100k of pension money by a romance scammer pretending to be an astronaut, claiming to need money for oxygen. 🙊

In Today’s Open Letter

Big Idea: Forget monthly pay, make payday now.

Local: SA’s electric dreams & growing cold on cash.

Global: YouTube’s $100 million bet against Twitch.

AI: Brands in seconds, moving UI & stock predictions.

Chart of the day: PayShap’s explosive usage growth.

Ready for tonight?

Over 120 SA founders, investors, corporates and tech insiders are meeting at Old Mutual in Sandton at 18:00 tonight.

The reason: To meet the man behind EasyEquities, mingle, network and make great connections, see about new products on WhatsApp and enjoy excellent drinks and food.

If you need to be in that room, hurry — there might be one or two tickets left.

TRENDING NOW

Why Can’t Every Day Be Payday?

SA banks’ outdated monthly pay cycle expectations hold so many people back – this startup’s working to put more flex in your payday…

South Africa’s financial system still operates as if everyone gets paid a monthly salary on the 25th. Yet a significant chunk of our workforce is paid sporadically.

For example, SA has around 92’000 active e-hailing drivers getting paid weekly in SA. Not to mention drivers in the rapidly growing on-demand economy and swathes of other workers getting paid every which way but monthly.

Even though they’re earning real income, because their money doesn’t land in one predictable lump sum, they remain invisible to traditional banks.

The variable-payday financing problem

So they struggle to qualify for loans, car finance or even basic insurance. Debit orders bounce when accounts are empty mid-month, even if cash comes in later. Savings tools don’t sync with weekly or daily pay, so these workers default to stokvels, cash advances or loan sharks.

In effect, the system penalises irregular income, trapping thousands of drivers and gig workers in a cycle where they can earn as much as R20’000 a month but still be deemed “unbankable.”

The local startup working to solve it

Kasi Money is a bank account and app built for how gig workers actually earn.

Users do everything from their phone using their phone number. From signing up, getting verified, ordering their (dare we say the hottest looking-) debit card, users can pick up their debit cards from Pargo pickup locations and instantly collect at selected Clicks locations to start banking right away.

Looking good there, cardie…

The Kasi Debit Card is powered by Access Bank and Mastercard, and works just like any other debit card. Users can track their transactions in-app, pay for services like Airtime, Netflix, electricity and more.

But it’s set up to function on variable pay: So a Bolt or delivery driver can put their weekly pay towards savings, repayments and insurance premiums that align with that weekly rhythm rather than a month-end debit order.

Even daily earners like car guards can opt into small daily contributions instead of failing a single lump sum at the end of the month.

When we chatted to Kasi Money founder Thami Hoza recently, he told us that, behind the scenes, Kasi Money’s underwriting looks at the frequency and timing of deposits to align on smart collections tailored to the cash flow of their users.

Cash income is digitised via vouchers bought at over 400k Spaza shops and retail points across SA, then loaded instantly into the user’s account.

If the South African banking sector were redesigned around income patterns rather than pay slips, millions of informal and gig workers could become visible, creditworthy and insured.

We’re watching this space…

TRENDING IN AI

3 Things to try in AI

Need a brand in 30 seconds? Brandolia gives you a name, logo, slogan, colours and fonts — all tailored to your idea. No design skills needed. Try here.

Want a slick demo without editing? Wevi turns your static UI into motion-animated videos in minutes — perfect for SaaS and indie apps. Start here.

Curious how AI predicts the market? Nostra Tech’s algorithm claims above-market returns and a $500M valuation just one year in. See if it works.

Sidekick Lab proudly sponsors Trending in AI

Need an AI solution that stages data from multiple sources, aligns with your goals, and delivers actionable insights on a streamlined platform?

FROM OUR FRIENDS AT SIDEKICK LAB

Data That Talks to You – in Plain English

Most companies have mountains of unused (and unmonetised) data scattered in outdated, disconnected systems…

One JSE-listed IT consortium had multiple companies with complex databases to navigate and legacy platforms that made getting insights across its diverse operations a nightmare.

Smarter data handling

Enter Sidekick Lab’s natural language query assistant. Using intelligent discovery and cataloguing, Sidekick Lab came in and consolidated all their data – spreadsheets, databases, even unstructured PDFs — into one intuitive hub, with intelligent enterprise-grade AI chat to help them make sense of it all, fast.

Easy access, faster decisions

Now, all company management has to do is ask: “What are the Q3 sales trends?” or “Show me customer patterns,” and they get clear, concise answers in minutes, all in plain English.

Complex budget-versus-actual comparisons that required specialist Power BI skills before are now just a simple prompt (by virtually any staffer) away.

And the system integrates seamlessly with existing enterprise authentication and scales across multiple operating companies.

Is there an easier way for mid-market businesses to unlock the potential of their data?

Not likely.

IN SHORT

Well, lookie here…

⚡️ Electric Dreams. Zero Carbon Charge is powering up with R100-million to extend its off-grid EV chargers along SA’s key N3 and N1 highways. Looks like the future is closer than we think…

🥶 Growing Cold on Cash. Standard Bank is ditching cash at more of its branches as the digital wave sweeps South Africa. We have to ask, is it too soon?

🎥 YouTube Taking On Twitch. YouTube has dropped more than $100 billion on creators, taking aim at Twitch's game with snazzy AI and mobile streaming upgrades. Things’re heating up…

🚅 Gaining Momentum. Momentum has just broken its own record with R6.26 billion in headline earnings, a whopping 46% climb from the previous year. Nicely done.

✅ The Stack. Founders need reliable tools and suppliers. That’s why our Founder’s Stack gives you your own CFO for a fraction of the cost with OCFO, WhatsApp marketing with 2'000% ROI powered by Chat Inc, and loads more vital startup tools & services.

LOVE IT?

WHAT YOU SAID

Shop life…

Yesterday, we unpacked SA’s explosive e-commerce market growth, asking what you buy online. Most say groceries…

🟩🟩🟩🟩🟩🟩 🛒 Groceries – Sixty60/Woolies life chose me (53%)

🟨⬜️⬜️⬜️⬜️⬜️ 👟 Fashion – Shein/Temu or bust (4%)

🟨🟨🟨⬜️⬜️⬜️ 📱 Gadgets & tech – my cart is basically a wishlist (33%)

🟨⬜️⬜️⬜️⬜️⬜️ 🍔 Takeout & meal kits – cooking is cancelled (10%)

⬜️⬜️⬜️⬜️⬜️⬜️ 🎁 Random impulse buys – TikTok made me do it (0)

Your 2 cents…

“I buy tools and equipment for my plumbing business. I also want to start a complete online plumbing supply store. However I am going to be far more selective in what products. I have been in the plumbing industry since 1982 and know exactly what will or will not work. Wish me luck.”

Great, Zero2one! We exist to inspire and help SA entrepreneurs, so we’re super excited for you. Let us know when it’s up and we’ll promo it in our Friday e-commerce slot. 💪

UP OR DOWN?

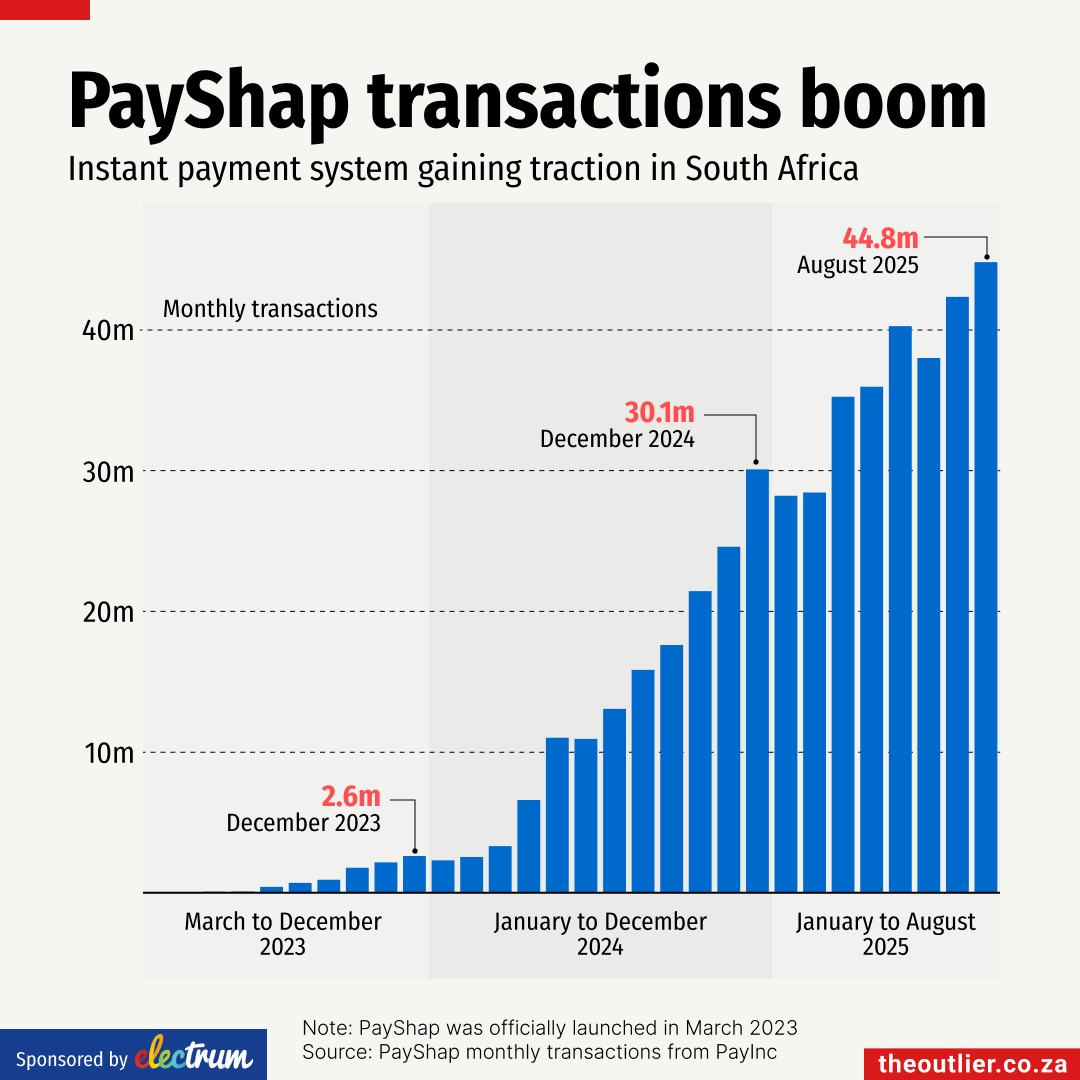

A graph that matters

PayShap is exploding — and digital cash is finally catching up to physical.

The numbers tell a clear story:

💡 PayShap grew from just 36k payments in March 2023 to 44.8 million pm by August 2025.

💡 That’s 461 million instant payments worth R403 billion in just over two years.

💡 With 5 million registered ShapIDs and 13 banks now live, adoption is only accelerating.

PayShap’s QR rollout in 2026 could finally put a real dent in the reign of cash.

AROUND THE WEB

🛠 Tool to Try: Snacrifice lets you track calories and macros by saying what you ate.

🤯 That’s Interesting: Japan has an eatery called the restaurant of mistaken orders that only employs people with dementia.

📹 Next Level: Massive Attack used live facial recognition at their last concert to critique surveillance culture.

🧠 Hack: Critical thinking? Here’s a guide to pesky biases that harm your decision-making skills.

🌐 Wow Site: BorrowedTime creates a new, bizarrely beautiful clock from internet images, every day.

THE FOUNDER COLLAB

Building a startup? Don’t do it alone.

Hey, Renier here 👋, co-founder of The Open Letter.

I’ve spent 17 years in SA tech and seen hundreds of startups rise and fall. The ones that made it all had one thing in common: a strong community.

That’s why I started The Founder Collab — a space where 100+ SA founders connect for:

☕ Meetups & events

🎓 Weekly masterclasses

📚 35+ expert sessions on-demand

🤝 A network unlike anything else

Come build your startup alongside me and 100+ other SA founders in The Founder Collab.

Spaces are limited — new founders join weekly.

THANKS FOR READING

Help us make The Open Letter more useful to you.

Vote in the poll, leave a quick comment, or hit reply — we read every single one.